What if I forgot the PIN?

Surely you have often heard storiesabout how someone forgot their PIN-code, and about what the consequences of this event were. And if this happened to you, you all the more imagine how unpleasant instantly you lose access to your means. Even worse situation for those who are abroad can not remember the PIN-code of the card. Although the bank's employees are on that, even without having information about the PIN-code, you can cash out your bank account.

In case of loss of information about the PIN-code

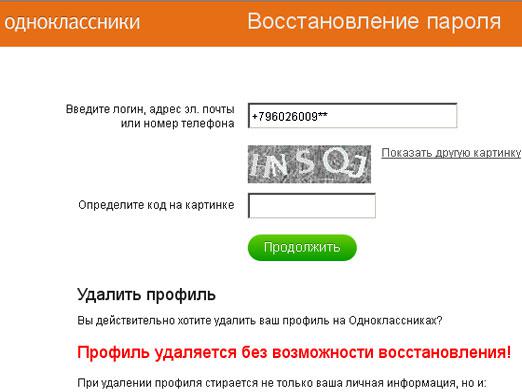

What if I forgot my PIN? - you ask. The first step is to report this to the bank whose client you are. The support service works most often around the clock, and is available at any major bank. Moreover, the call to the bank's support service is free. When you call, you will receive instructions from the operator how to proceed.

Since the PIN is known only to you, resumeit is impossible. Therefore, the loss of information about the PIN code automatically leads to the re-issue of the bank card. Fortunately, the bank number will remain the same, you just get a new card. It is important that when re-issuing the card, the possibility of obtaining a PIN number by third parties is excluded.

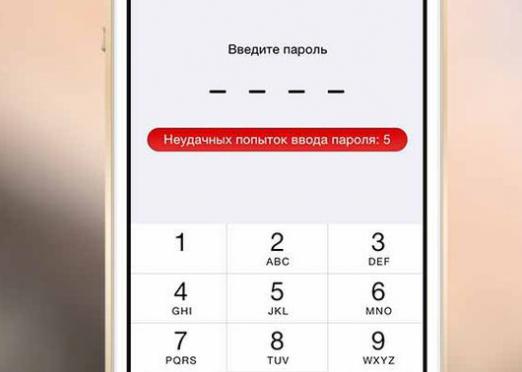

Very often, forgetting PINs, cardholders,rely on the case and try to remember it, further exacerbating the situation. It is important to remember that if the PIN was entered incorrectly more than permissible attempts, the card is automatically blocked and can be withdrawn by the ATM. Therefore, naturally, it is best to remember this important combination of numbers well.

When all the same trouble happens, and you do notyou can remember the card code - you can not do without a call to the bank. In the event that any client of the bank has forgotten the PIN-code, what to do in this situation should tell the employees of the bank by phone. At your request, the bank can reset attempts to enter the PIN code.

Possibility of receiving cash

If you need money today, and the card is alreadyblocked, as a result of incorrect input of the protective combination, do not lose hope - the opportunity to get cash is still there. A card account is just your personal bank account, access to which you had through a plastic card. Undoubtedly, without a card, it is also possible to carry out all banking operations. Therefore, in order to receive money, it is necessary to present a document proving the identity in the bank branch.

There can be exceptions to the rule. Receipt of money without a card may be impossible if it is not provided by the type of card, bank rules and local legislation. For example, it is impossible to get money on a passport if the card is blocked, as this means a ban on all transactions with the account. If the lock was made because the PIN was incorrectly entered, the operations with the card will resume at midnight Moscow time. But even in the situation, if the client did not remember, or again forgot the security code, what to do to get cash tell the employees of the bank. But, remember that for withdrawing money from the Maestro card, identification by PIN-code is mandatory.

Loss of information about the PIN-code abroad

If you forget the PIN number while in another country- Cash out the account will be much more difficult. Even worse, if there are no branches of the issuing bank nearby. Although, even when abroad, the cardholder who forgot the PIN code, what can he do, can always find out by calling the support service of the bank that issued the card. Basically, the phone number of the service is on the ATM. That is, the initial actions that are at home, that abroad are the same. Further, after submitting the application to the bank, within 3 - 5 days the card must be returned, or issued temporary. It is worth noting that not all banks operate under such a simplified scheme. In this case, when you are abroad, you can carry out using a purchase card, paying for goods and services, since these operations do not require a PIN in most cases.

Ways to avoid problems

It is better to prevent the problem than to look for itdecision. Therefore, when going abroad, it is necessary to issue a power of attorney for access to a third party bank account. In the cases described above, his assistance will prove to be very useful: he will be able to solve the problematic issue in his homeland instead of you.

Even better, if you pre-order severalplastic cards to one bank account. After blocking one card, its owner can always access the funds using a twin card.