How to write a balance sheet?

Drawing up a balance sheet - verylabor-consuming process that requires the chief accountant of an enterprise, organization or company to focus on and focus, as well as possess information on the financial situation in the enterprise. Before you create a balance sheet, the accountant should check all settlements with counterparties, summarize the information relating to the active part of this financial report, and also know about all the material costs of the enterprise that will be reflected in its passive part.

Balance active

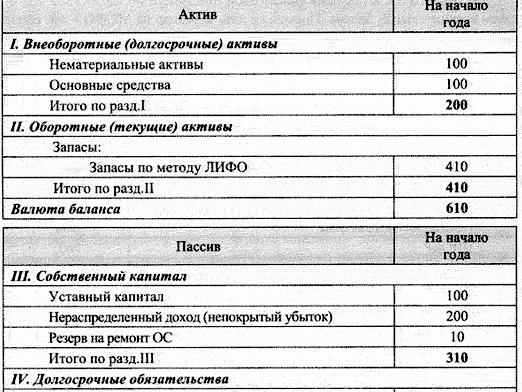

Experts recommend starting the fillingbalance sheet for the reporting period with the filling of its active part. But, before filling this part, it is necessary to know what is included in the asset of the enterprise. The asset is property belonging to a legal entity, namely, fixed assets and finished products, financial investments and so on. Strictly speaking, an asset is something that can bring an organization profit. While filling the active part of the balance sheet, however, like the liability, it is necessary to remember that there are accounts that can be attributed to both the asset and the liability. This is due to the fact that "Calculations for taxes" or "Settlements with suppliers", as well as some other accounts can bring the enterprise, both profit and reduce it. Therefore, these accounts are called "active-passive".

Passive balance

The passive part of the balance is formed from the accounts,which a priori can not bring profit to the enterprise. In the passive part of the balance sheet, there is a trade mark-up and amortization of fixed assets, intangible assets, credit funds and so on. If you are a new employee and do not know how to write a balance sheet, take an example from the balance for the previous reporting period. According to him, determine that for this enterprise are the main liabilities, and also study information on changes, new operations that can enter the passive part of the balance sheet. If you are not sure which accounts to include a specific operation, use the chart of accounts, as well as the accounting program 1C. It is good that next to the name indicates the type of account.

Balance Filling Algorithm

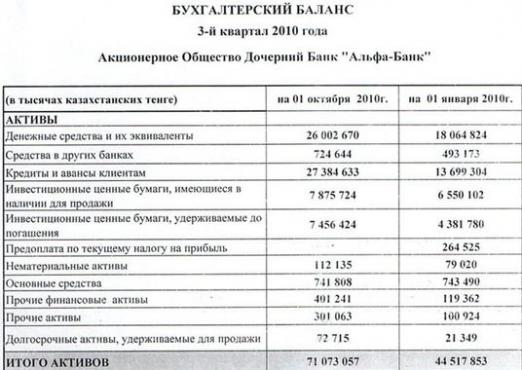

When filling the balance sheet in no wayIn case there is no way to avoid blots, since this financial report is submitted to higher organizations, to the statute, it is checked by the controlling bodies. The balance is drawn up in the main state currency, that is, in rubles. Employees of those organizations that have foreign currency accounts or settle accounts with counterparties in foreign currency must transfer foreign currency into rubles, in accordance with the exchange rate of the central bank, which is typical for the day when the balance is filled. The balance of the enterprise is made only in thousands of rubles - the accountant should not indicate in the balance the decimal values. Negative balance indicators are written in parentheses, but not with a "minus".

If you are tasked with compilingbalance sheet, it is necessary first to fill in the relevant lines of financial indicators of the enterprise at the beginning of the reporting period. They are indicated in the balance sheet for the previous period, namely, in the column "At the end of the reporting period". Exceptions are only those cases when for the period between the previous and the current reporting period there was a reorganization of the enterprise, structural unit or branch.

In the balance sheet there are codes - theirmust be observed without fail. What is it for? The fact is that the standard balance sheet was developed so that controlling organizations could check the enterprises of absolutely any kind of activity, therefore a unified system of codes was created. Even if the balance is filled, which was compiled by the organization itself, then the line codes should be provided in the same way as in the standard balance sheet.

Refuse to fill a quarterly orannual balance is impossible, since this norm is fixed at the level of the current legislative base. The lack of balance at the enterprise entails responsibility for both the manager and the chief accountant. It should be noted that nowadays it is possible to compile an online balance sheet, but this does not mean that there should not be a paper balance in the enterprise's reporting.

A balance sheet is submitted to an organization whose listdepends on the form of ownership of the organization, at specific times. Failure to meet deadlines can be fraught with negative consequences for the organization. Thus, after the preparation of this document, the chief accountant must make as many copies of it, how many organizations he must give up.

Checking the correct balance

Before you properly compile an accountingbalance, you must check all the calculations with the tax inspection. Having made a reconciliation, you will be sure that in the part of taxes on profits, on wages, on land and others, all the figures in the balance will coincide. The company transfers taxes to organizations such as the Pension Fund and the Social Insurance Fund, so it is necessary to check the calculations with these services before drawing up a balance sheet. Disregarding these rules, you will make mistakes that will later have to be corrected. And this means that you will have to redo all the reporting.

If you have correctly drawn up a balance, then indicatorson its assets must coincide with the indicators on liabilities. In the event that you have a different situation with the balance, you need to recheck those points in which you could make mistakes. Correctly filled balance will show the real picture of the financial condition of the enterprise. That is why, based on the balance sheet indicators, profitability and indicators for the volume of sales for future periods are planned.