How to make a gift agreement?

There are several ways to transfer propertyfrom one person to another. If before the transfer of the inheritance is still far away, you can just give this property. You just need to know how to draw up a gift agreement correctly, so that the state, tax, controlling and registering bodies do not have any questions. Of course, it is best to draw up such a contract with a lawyer, to assure a notary and subsequently register a new property by the recipient. In principle, the process is simple, as lawyers say. Suppose you decide to make a gift agreement yourself. You can take the form from specialists (notary, lawyer). For more information on how to leave a promotional one, read here.

Features of the contract

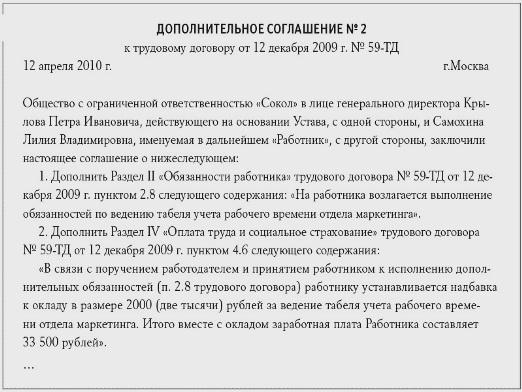

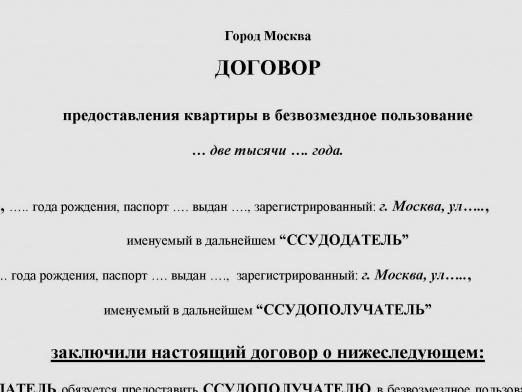

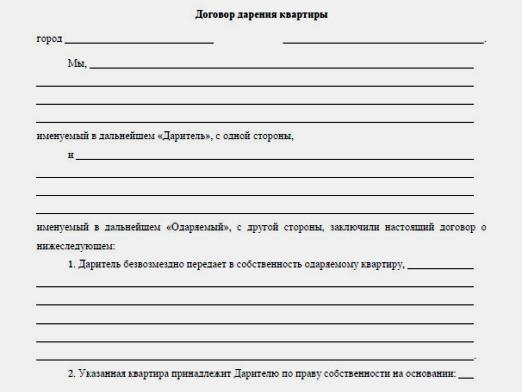

In a gift contract, the donor does not have the rightto give the recipient any conditions, everything is transferred free of charge and without any obstacles. For some donors, this is a significant disadvantage. For the recipient, too, there are minuses in the gift. Also, the recipient will register his gift for a long time, because this procedure can take up to six months on the basis of the gift contract. Write a written gift agreement can be with the date that will be after some time in the future, at the choice of the donor. You can even specify after what event the gift comes into effect. And if the donor has died, not having registered the gift from the notary, then the contract is recognized as invalid. Any of the parties to the donation can act as individuals, as well as legal entities, as well as the state. The form of the contract may be oral or written. A gift only in writing applies to real estate. The apartment can not be presented on the basis of an oral application, it is mandatory to draw up a contract for the gift of an apartment. As well as how to give an apartment you can find out here. Here such features have a gift agreement. You can always find a sample of it on the Internet, see what it represents, and understand if you can fill it yourself.

Subject of the gift agreement

The subject of the gift agreement should be clearly definedin advance, before you begin to fill the contract. It can be an apartment, a house, a garage, in short, any real estate. The bulk of the donors are passing the apartments, according to statistics. You can also give money, property rights to intellectual property, securities, any thing that represents value. You can not give everything that is classified as a service. This completely contradicts the meaningful purpose of the treaty.

Documents for the contract

To conclude a contract you needto provide a package of documents, and for each list of property he has his own. First of all, you must have on hand all the documents that confirm the right of ownership of the donor to all donated property. After all, if it does not belong at least in part to the donor, then the contract will return in a month from the registration service for revision, which means that all efforts and expenses will have to be repeated. And the second of the required documents for donating is a passport. Copies will be required from both the donor and the recipient.

Termination of gift agreement

To terminate the gift contract can only court incertain cases. First, if third parties prove the incapacity of the donor. It's very difficult, but sometimes it happens. If the donee has committed an attempt on the life of the donor, on his family members, on relatives, or caused them bodily injuries, the contract is canceled. If suddenly the donor will seem that the recipient of the gift is not treating him well, which creates a threat of loss of this thing, and she is very dear to the donor from the non-material point of view, he can also cancel the donation through the court. Also, the donation is canceled if the recipient died before the donor, and this was provided in the contract initially, as a condition.